Allow me to introduce NinjaTrader to you...

I started trading emini futures in 2002. In 2003, NinjaTrader appeared on the trading scene and I became one of its first users. With its innovative DOM, this software was clearly ahead of most of its competition for there was only one more software of its kind back then, but not necessarily that well designed. No wonder then that it disappeared pretty fast, within several months only, and those that have survived from those days had to jump on the NinjaTrader bandwagon in order to please their users.

The SuperDOM, as it is now called, was a big deal back then and today it

is even hard to imagine how you could possibly trade without it.

However, the history that NinjaTrader made with this innovation did not stop there. Over the years, its developers kept making it

better and better, adding things that continued to make it stand out in the crowd of similar applications.

While trading from charts was not introduced by NinjaTrader, it is probably fair to say that it was NinjaTrader that made it much more user friendly and reliable, not to mention popular, than it had been before. These days, some of my clients don't even want to use the DOM, for they simply prefer trading from charts. While I

continue doing things the old-fashioned way of 2003, I do not blame them for choosing trading from charts over trading from the SuperDOM. If you can, choosing an easier way is certainly a way to go. To me trading using the price ladder is already easy enough, but that's just me.

NinjaTrader has always come with an option to simulate trading in a pretty realistic

way and this option has always been free too. But now you can also use charting and analysis totally free, a deal which is

very hard to match, if at all. Of course, you may need to pay for a data feed, but that's usually a small fee that sometimes gets waived if your feed comes from your broker and you trade frequently enough, as is the case with Interactive Brokers.

One more thing that also makes NinjaTrader a great piece of software is its widespread availability. When it was launched in 2003, NinjaTrader was

available only as a trading interface for Interactive Brokers TWS, and that's why I was lucky enough to get my hands on it back then. These days, NinjaTrader is available for trading with many brokers and those who don't offer it cannot be taken seriously.

If you enjoy programming and have time for it, you can program your own indicators using Ninjascript, a special scripting language developed for NinjaTrader

needs based on C#, a highly popular, versatile programming language developed and supported by Microsoft.

I highly recommend NinjaTrader to all my clients and visitors to this site.

To even think about becoming a good trader, you need to master your

tools first. Since the software comes with excellent support provided

through many videos and an online forum, mastering it well is pretty much the matter of time rather than intelligence.

If you wish to learn more about NinjaTrader, check out more information on this page. For still more, the links below will take you to the software website, where you can also download it for

a more thorough evaluation.

NinjaTrader's simulation engine factors in bid/ask size, last trade, time and order delay to determine the fill probability. You can use the simulator to forward test your strategies or to simply improve your trading skills. You can use the fully-fledged software for trading them live.

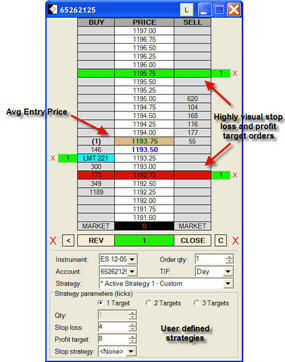

SuperDOM

The NinjaTrader TM SuperDOM is a proven success with futures traders around the globe. It is a highly intuitive and extremely efficient interface used to place orders, manage positions, and position strategies. You can place orders, modify a pending order,

or modify stop loss and profit target orders with the click of your mouse or by using

the Advaced Strategy Management (ASM) functionality.

Either way, all orders and positions are intelligently visualized so you can instantly recognize where you are at in the market. If the timing of your entries and exits are critical then you need the NinjaTrader SuperDOM!

- Static price display where the inside market dynamically climbs up and down the price ladder with changes to the bid, ask and last price

- Highly visual and intelligent order and position display

- Flexible display options such as number of price rows and color parameters

- Auto centering

- Consolidated order display

- Pre-defined quick entry buttons

- Bracketed orders on entry