George IV - Notices (2016)

(1/31/16)

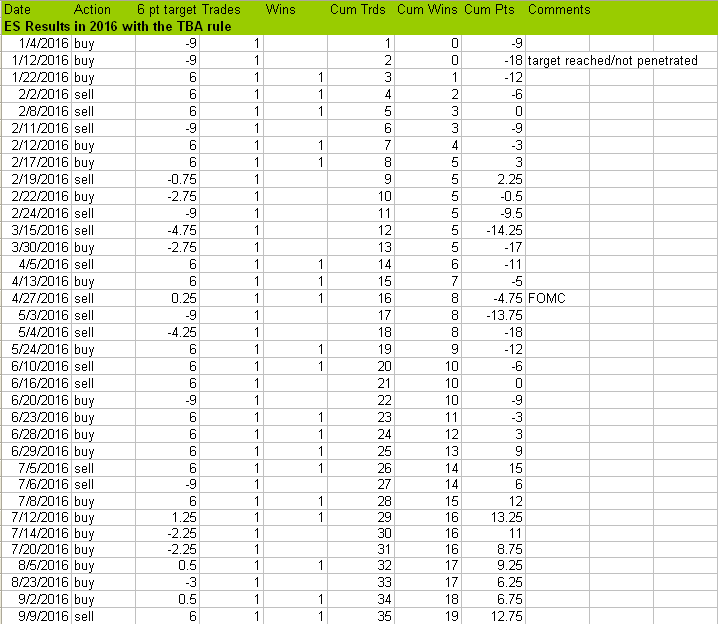

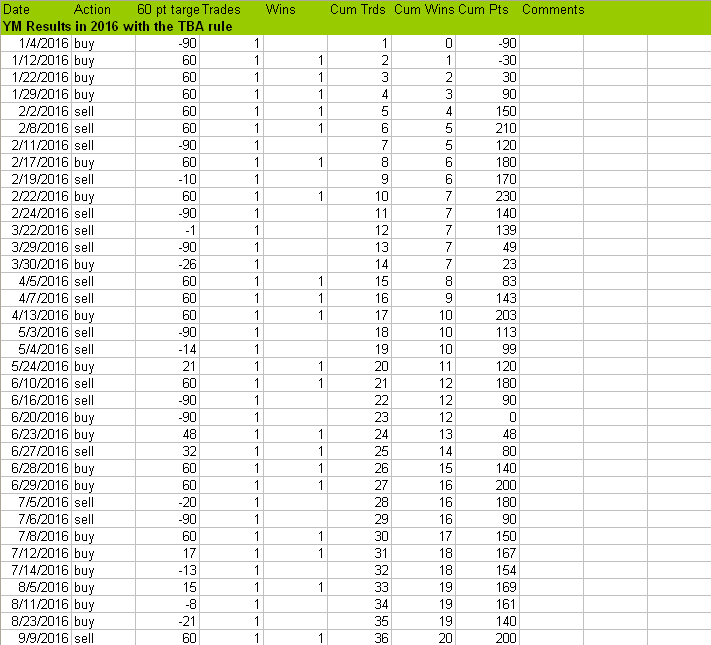

I continue posting the results for this system that I restarted in 2014 and continued in 2015. This year, I will track the system performance with the TBA rule, just as was the case in 2014. As you can see from the results in 2015, without this rule the system takes more trades and their overall quality is inferior compared to the trades selected by the rule.

The trades reported here are limited to the system basic entry with some slight modifications (just as in 2014 and 2015), which is the original entry the system was launched with and the one most likely to do well even in less than optimal for this system volatility conditions.

This year, the results will be posted here less frequently, but at least once a month. Keep in mind, however, that I always mention the trading results of this system on the days it trades via Twitter, so you can easily track them and even learn how to use the system by following my Twitter feed.

While the performance reported here will be limited to the strictly mechanical, objective results, you may also benefit from this system (and perhaps even more so) by using it for discretionary trading, especially in combination with KING. I have heard from more than one KING student that they do better on the days when George IV can offer its guidance.

If you are totally new to day trading e-mini futures, you may not know that 1 point in YM corresponds to $5 and 1 point in ES corresponds to $50. These numbers become quite round ($10 and $100, respectively) if you trade with 2 contracts, which many a retail trader should easily afford. In such a case, 100 points in YM, corresponds to a cool $1000, and 100 points is not that hard to get with this system under normal conditions. Note that the system is only $400.

One more thing worth noting is that I assume that the target of 6/60 points in ES/YM, is reached only when it was penetrated by at least 1 tick in ES and 2 ticks in YM. This is not a standard way of accounting; in fact, it may not be used by anyone else. However, this way ensures that the results posted here are much more likely to be achieved in actual trading by the majority of traders. It also means that they are worse compared to the standard way of accounting, but I can live with that. For instance, had I used the standard way of accounting in 2015, the results in ES would have been better by at least 10 points! I have used that way for many years, in 2014 and 2015, but also in years prior when this system was tracked.

The system recent equity curves (2014-2015) can be seen here.

What follows are the trading results for the two e-mini futures markets that this system has been proven to work. They are shown in the form an Excel spreadsheet that you will obtain with all the past results for this system (over 4 years in total), when you purchase it or when you purchase KING, which includes it.

ES

YM

Last updated on September 11, 2016.

Further updates will follow once the KING trading forum, where this system is also discussed in a special section, is re-opened, that is, in the last quarter of 2016.