KING - My e-mini trading results in 2012 - I can do it too!

This section features the fifth year of my day trading results with KING with, among others, 16 samples of a continuous full week and 2 periods over two weeks long.

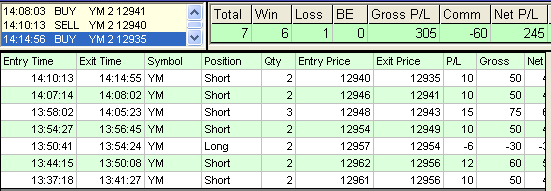

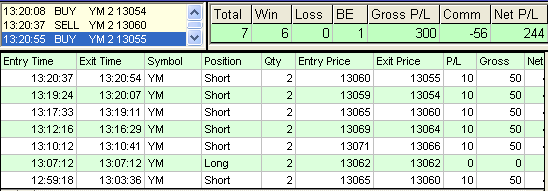

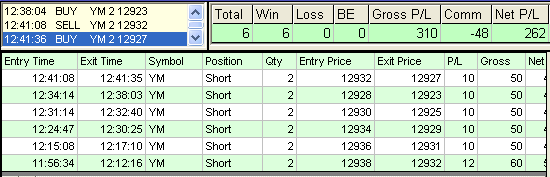

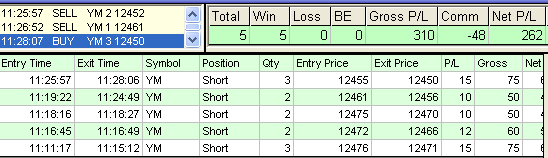

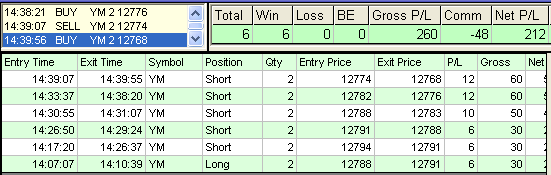

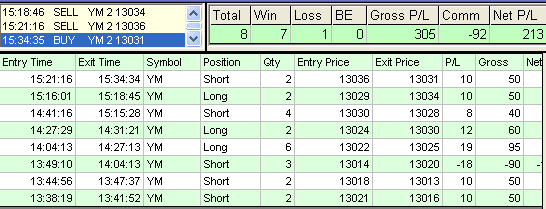

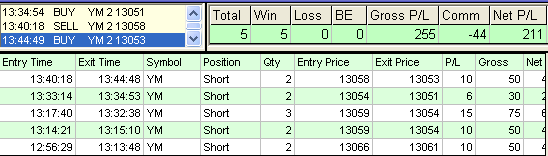

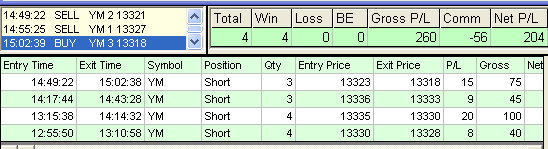

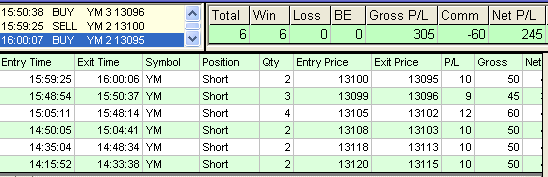

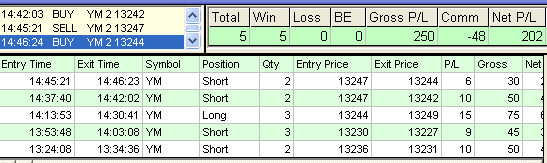

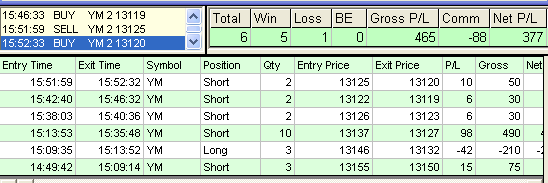

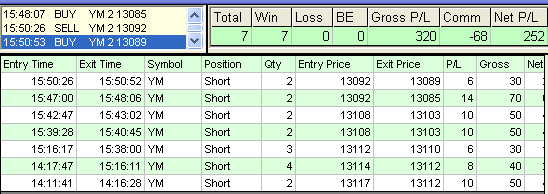

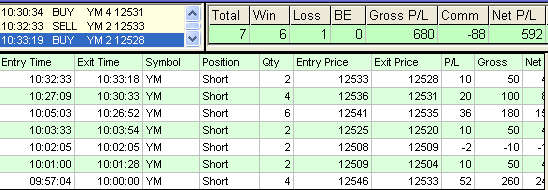

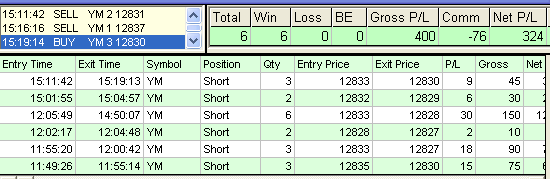

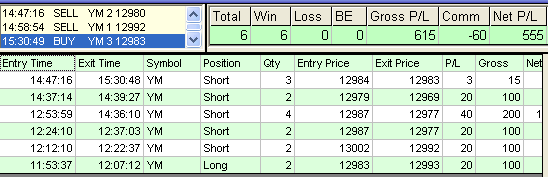

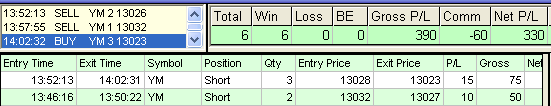

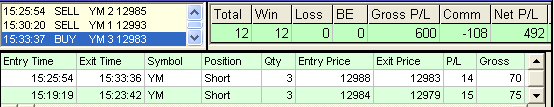

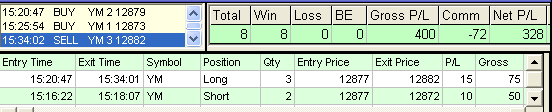

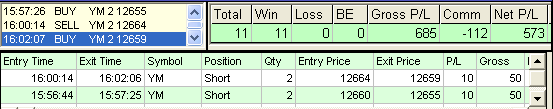

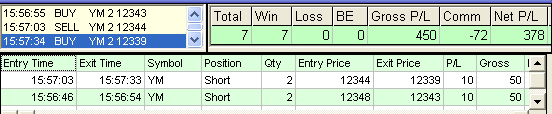

Half an hour again?

Well, more or less, and the day is Friday, December 28th. Trading can be boring at times, especially after you have been doing it for years, but there are more boring things than trading, and the boring aspect of trading to me, and probably most other people out there, is waiting for the trade to reach your target. Fortunately, with KING this does not have to be that boring at all because you can be done with your trading in just 30 minutes or so if you aim at $200 or so with only a handful of contracts. But figuring out the market has never been boring to me and with KING, a discretionary emini trading methodology par excellence, this can actually be a lot of fun. Of course, if you are looking for something that would make you money by keeping your involvement to merely pushing the buy or sell buttons, then KING is not it and I, for one, even like it that way.

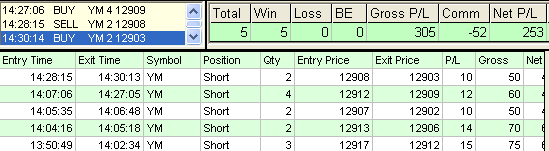

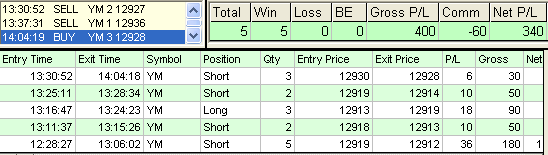

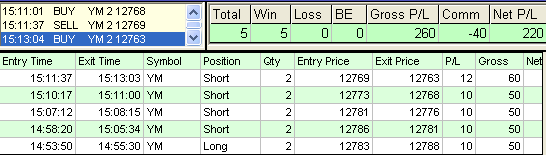

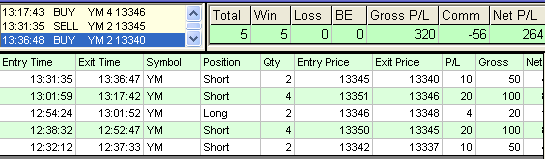

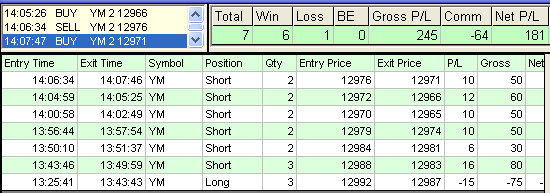

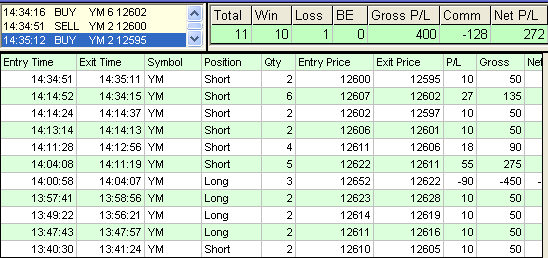

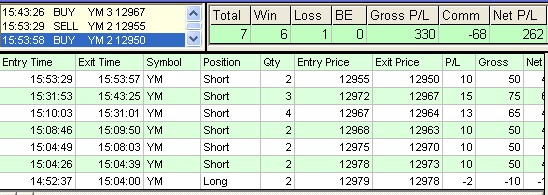

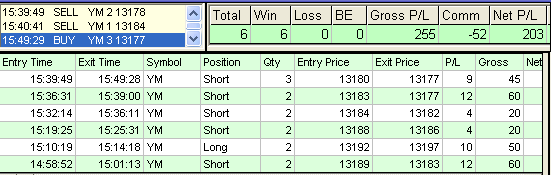

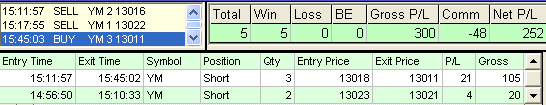

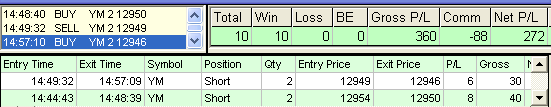

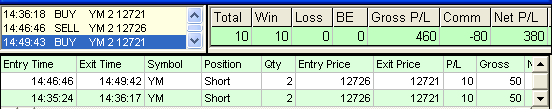

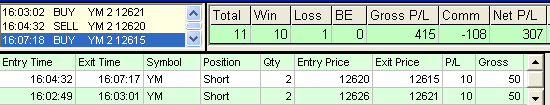

Holiday week

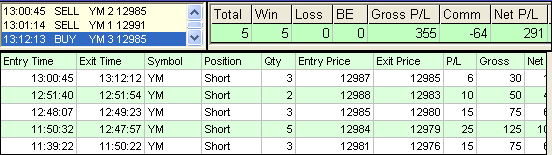

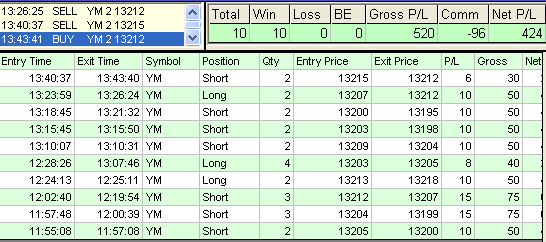

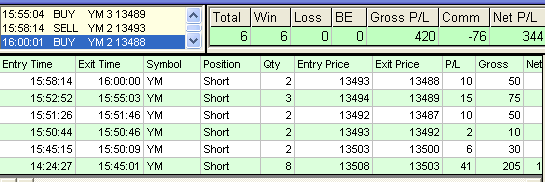

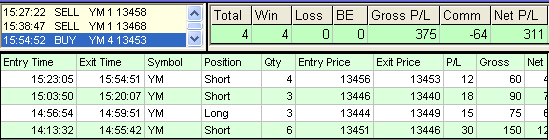

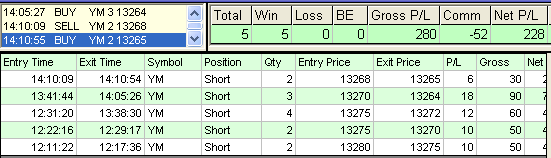

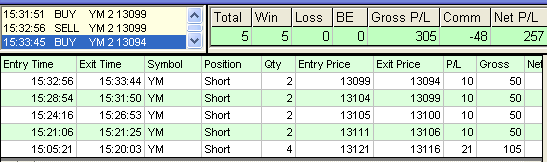

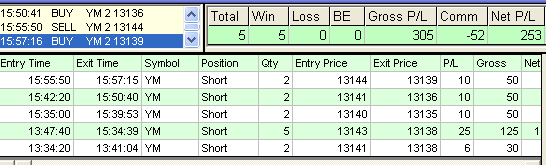

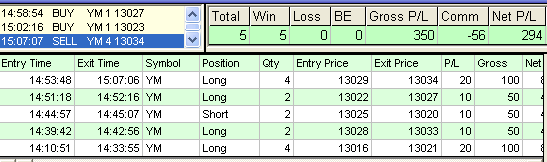

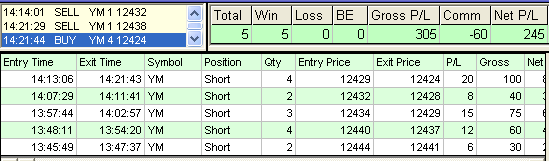

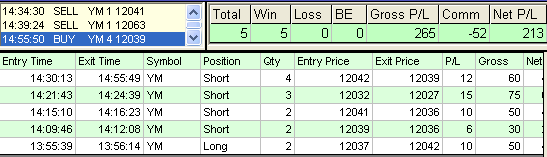

Thursday, December 27th. The market was moving in a range, so I was not able to score any quickies, but came close to in more than one situation. Well, just another of those 5 trade screenshots with over $200 in profits, which is the main goal of this page with KING emini trading results.

I hate round numbers!

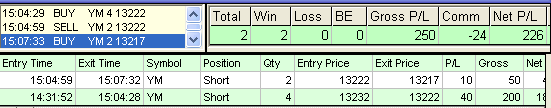

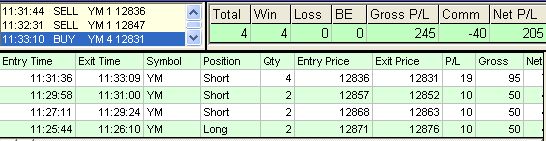

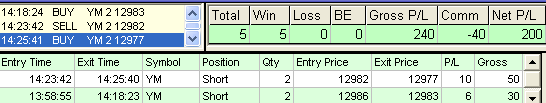

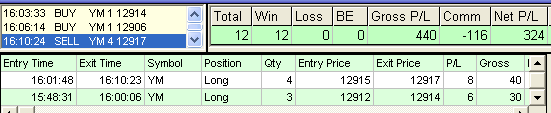

Did you notice how special they feel? I mean round numbers. That's because humans love to round things off. But, honestly, I think that if there are any special numbers it is the prime numbers, and no round number will ever be a prime number. So, I thought that before the world ends I should really change the counter to a nice prime number and 401 is just such. I did it on December 20th. I managed to take only 2 trades, but one of them was a nice 10-pointer with 4 contracts, so who can complain. Well, happy end of the world, or whatever it is that you wish people on such an occasion.

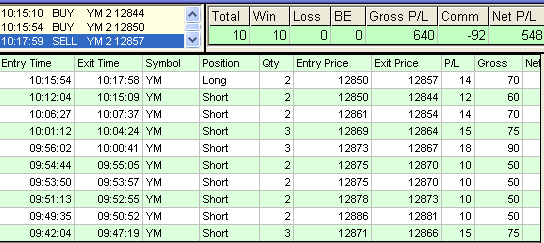

400!

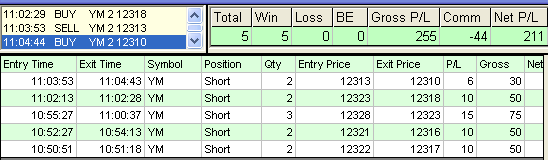

Yes, that's screenshot number 400! 400 daily trading results over about 4 years since the KING release in late 2008. That's not bad. Originally, I did not plan to post that much, and this year I am probably a bit hyperactive, but next year may not be like that. Incidentally, that's also practically 3 weeks of trading results in a row, with a one day of break when I had to see a doctor, which I mentioned before. It's good to take a break from time to time, anyway. I don't trade more than 15 days a month on average. Today is December 14th, another Friday, and I am glad I have managed to reach screenshot number 400 before the end of the world on December 21st, in which, as I said in my previous post, I chose not to participate, so you may actually hear from me next year. Here is a screenshot of the 5-minute Sierra Chart chart that shows where I started and finished trading today. As you can see from it, it was a pretty smooth ride, my timing being very good. I started trading right about the time the market was to drop. Did I anticipate it? Sort of. That was a good gamble, but good gambles favor a prepared mind. If you train yourself well with KING, you too can be a successful gambler. Trading is really gambling as I said in more than one place on this site. With all copies of KING at $1000 gone, I decided to extend my holiday KING offer till December 24th, but not any longer. Survivors of this year's end of the world are particularly welcome to join the growing club of KING students.

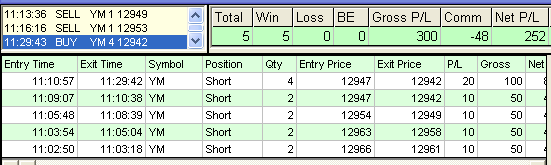

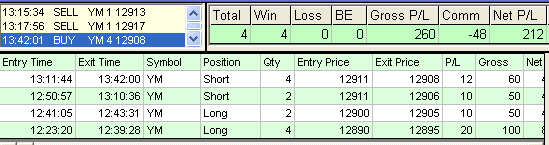

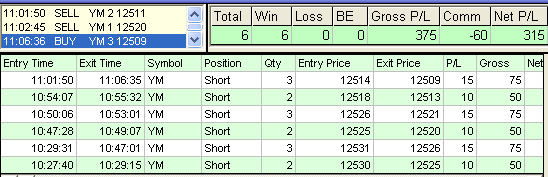

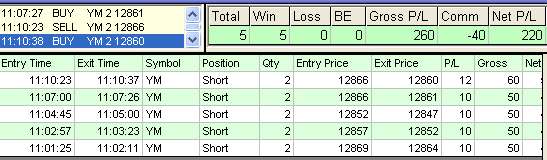

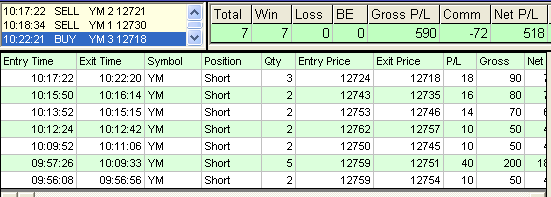

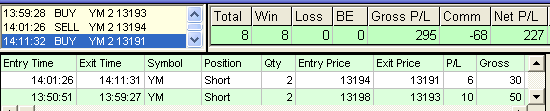

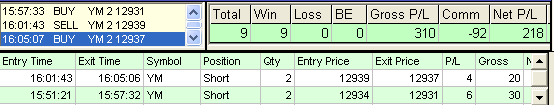

399

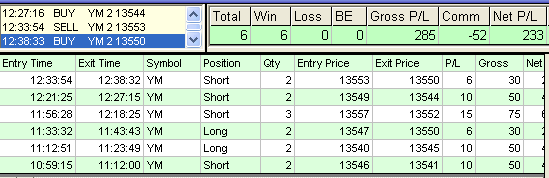

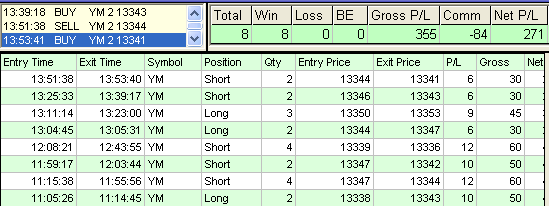

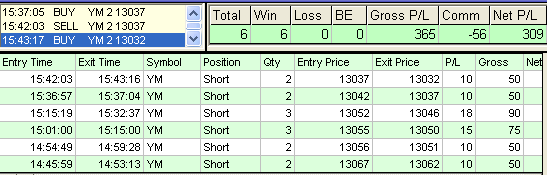

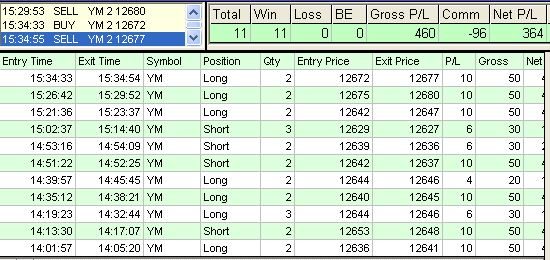

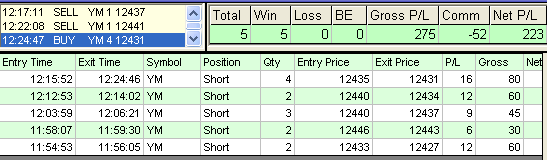

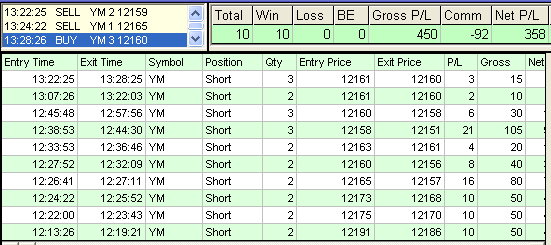

One screenshot away from screenshot number 400 in this glorious results section. I am hoping to get there before the end of the world on 12/21/12. I mean, this year's end of the world. Last year's was in May 2011, if I recall it correctly. Nothing came out it, so I decided not to participate in this year's end of the world. Sorry, but you gotta do it without me. I will be busy doing other things. Anyway, today is Thursday, December 13th (we missed Friday by one day, what a relief) and it was another good day. It started with a quickie and the rest was pretty smooth too. This Thursday is also a rollover day and I was trading a new, March, contract. You might have noticed that I tend to short a lot. Well, I may write about it in future, but that's actually kinda natural, although don't expect to learn about it on a trading forum.

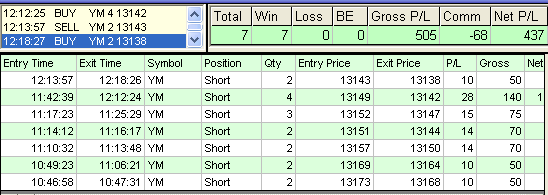

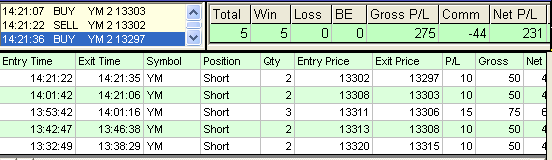

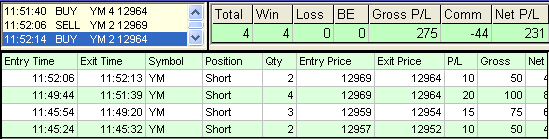

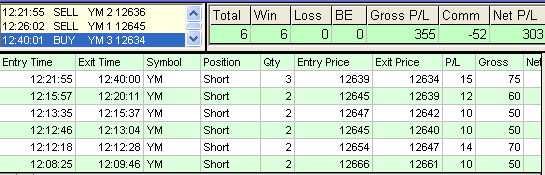

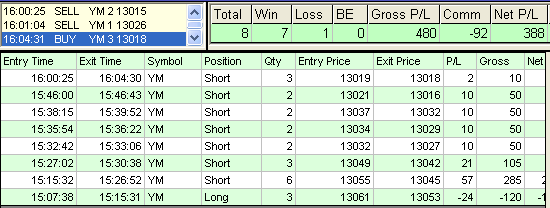

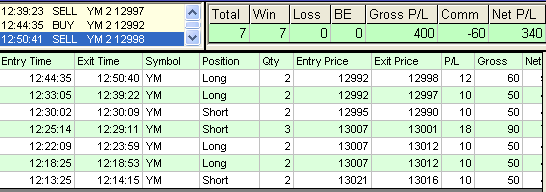

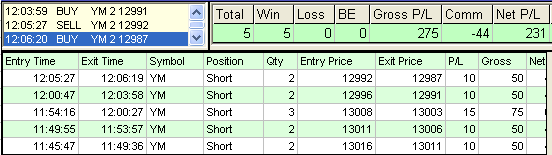

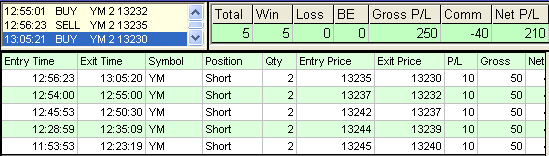

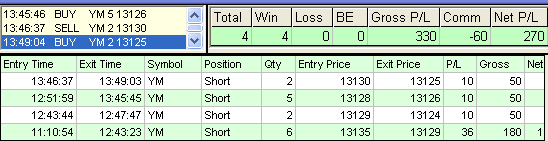

12/12/12 = 398 = $231

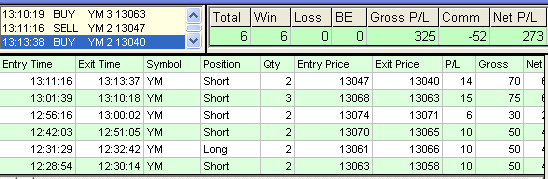

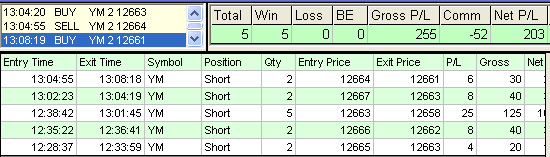

Odd math? Well, let me explain it to you. Today is December 12th, 2012, so 12/12/12. Or 12/12/12 in the British system. It's also the 398th screenshot posted in the "I can do it too" section of e-mini trading results and $231 is self-explanatory, I think. Another good day, all trades hit the 5 tick target and the last one did not take even a whole minute to do so (not even 15 seconds!). Just to remind you, the end of the world is on 12/21/12 (or 21/12/12 in the British system). I still have one copy of KING at $1000, so hurry up! The end is nigh!

397

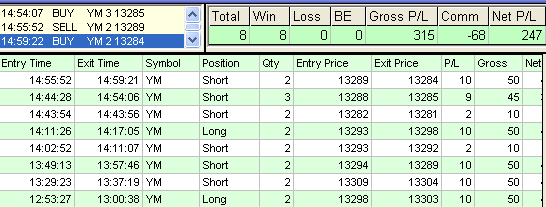

That means we are only 3 screenshots away from screenshot number 400. I may not post it here this year as I am pretty busy with many things at this time of the year and I am also working on revamping this site. I am posting this one late on Monday, December 10th, and that's the 11th trading day in a row. I am seeing a doctor on Tuesday, so I won't even be trading tomorrow. It was a good day and I took a chance of shorting a double-layer resistance with a bigger size which usually works out well, but I was running out of time, so I took only about 3 ticks (per contract) from this trade. More was certainly possible, even 10.

2 second long trade to complete a 2 week long

sequence of results

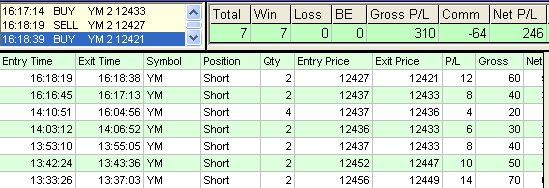

That's nicely symbolic, a nice closure to this 2 week long sequence of daily e-mini trading results. Thanks, Mr. Market. I did not expect it. Less than half an hour of trading and most trades reached their 5 tick target as intended and that 5 contract position could have too had I stuck to it for just a few minutes longer. Well, I hate to start trading on a Monday and end on a Friday, but that's what I have done two weeks in a row, so perhaps I will eventually get used to it. Like when I am dead. That's the second 2 week long sequence of results posted this year. I rarely trade that long without taking a break or being forced to take a break, but two years ago (in 2010) I did 4 such sequences. It is also the 16th full week of daily trading results posted this year. Most likely the last one such a sequence this year. There are about 130 screenshots posted here this year, and that's more than 50% of all trading days a year and I don't trade every day. We are also only 4 screenshots away from screenshot #400, which might arrive this year or early next one. Today is December 7th.

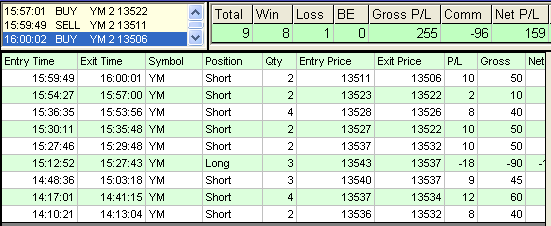

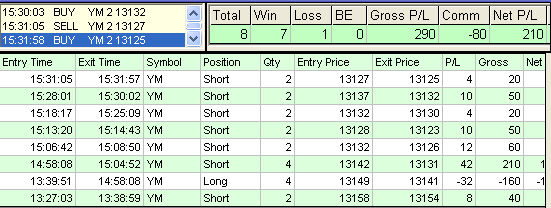

Not the smoothest trading day

But it started well, with yet another quickie, but then volatility dropped and my patience was not up to the task necessarily either (did not get the best sleep last night), so as a result I ended up with as many as four 3-pointers (per contract) instead of 5-pointers or better that I routinely aim at. And if this were not annoying enough, it turned out that each of these 3-pointers could have been a 5-pointer given a bit more time to evolve. Well, all's well that ends well, as they say, so I don't think I should complain too much. Anyway, today is Thursday, December 6th.

Nice ending this time

And that's because the last two trades did not take even a whole minute each. There was one more trade like that today, so altogether that 3 quickies out of 7 trades. Not too bad. That long breakeven trade was the result of accident: I messed up things while adjusting something in Bracket Trader. It was the right position that would have reached its target of 5 ticks. Today is Wednesday, December 5th.

Another nice beginning

This time the nice beginning of today's trading for I opened it with a quickie that took only 28 seconds. That was not a perfect 5 because I added to the last position, but thanks to that I did a bit better than yesterday in about the same period of time, roughly half an hour. Today is Tuesday, December 4th.

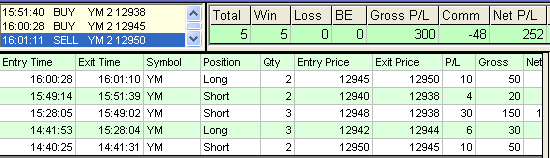

Nice beginning of the last month of this year

No, this will not be the beginning of the 16th full week, but then again, I wanted to stop at the 12th weekly cycle this year a few months back and could not, so only time will tell if I keep my promise this time around. It was an easy day, just as it should be. Trading does not have to be hard. It shouldn't. If it is, you need to practice more and you need to practice being more relaxed as well. Yes, some days will be harder, and sometimes we end up making it harder because we are trading when we should not be. That's why I stopped after 5 trades today because I did not see this market moving well and was getting a bit too impatient. It's better to stop in a situation like that. Being flat is a trading position too. I doubt I will be trading more today, but since the purpose of this section is to show how you can make $200 a day with a few contracts per position I thought I would post here at this particular point. Today is Monday, December 3rd. There is now only one copy of KING left at $1000.

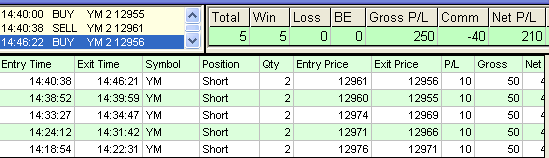

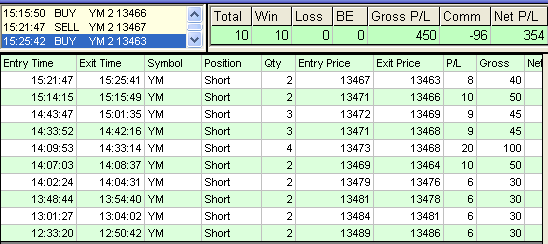

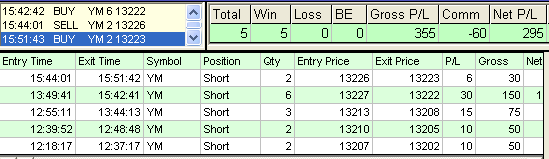

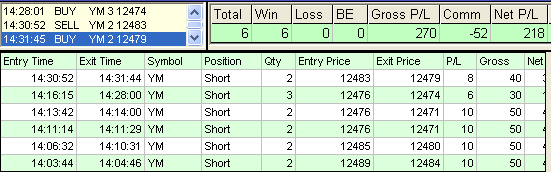

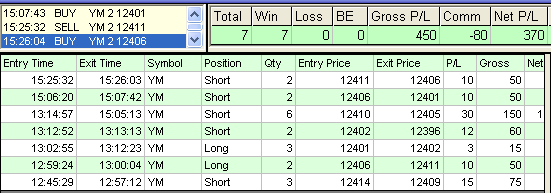

Nice ending of the 15th full week of results this year

On the glorious day of November 30th. I was shorting because the market had a short bias and I only wish I could have added one more contract to that 5 contract position but the price stopped 2 ticks short of my 6th contract position. That was a double layer resistance that I was shorting and those can be pretty solid as a support for your position. Well, it's another Friday, and it's raining in LA, so that would be it.

Brilliant

If I may say so. Less than 7 minutes of trading, well over $200 in profits. You can't do this with your system, but you can do this with KING. That's because KING, being a discretionary methodology, is much more flexible than most day trading systems out there. I was a bit surprised by the volatility in this pullback that I was shorting (about 40 point move in the span of 8 minutes or so), and so I was reluctant to take another short even if (in hindsight) this would have been warranted. Well, anyway, I may trade later on. Meanwhile, time for a solid breakfast, it's only about 9 AM here and I have not eaten much yet. That's the report from Thursday, November 29th. We are only 10 screenshots away from screenshot #400 as this one is number 390. And did I mention that the first and the last trade did not take even a minute? In fact, not even 10 seconds, each! Incidentally, KING is now only $1000, for a while.

Still better

Another day, November 28th. I was up over $200 after the second trade already, but I try to take at least 4-5 trades before posting here as long as I have time to do so. So that's 5 trades again. My goal, at least for this section, is $200 a day and as you can see the overwhelming majority of screenshots prove that this is possible with KING ideas. The last trade could have been a 5-pointer as intended (and even 10-pointer, as a matter of fact), but I lost my patience after 30 minutes or so. The first trade was intended to be a 10-pointer, but after over 30 minutes I went for a reduced target. I was betting against the trend, but since at that moment the market was up about 150 points since the low of the daily session I thought it was a sound bet and I was prepared to build my position here. When I do so, I try to limit it to 6 contracts, but I can go a bit over it in rare but warranted cases. Anyway, no fireworks today, no quickies, but not a bad day either.

A bit better

And the last trade was a quickie (less than a minute in duration). That's a memo from November 27th.

A bit rusty, but still okay

It's November 26th and I had not traded for 10 days, so I was a bit rusty. The first trade could have been a short one equally well, but I meant it to be a long-term trade and I was prepared to add to my position which I did. It could have been an easy 10-20 pointer. The last trade could have been a long too, but I chose to go short instead, and while it worked out okay, going long at that time would have been a tad more smarter and I would have reached my target sooner, just as going short on the first trade would have taken me to the target of 5 ticks sooner. I could have reached 5 ticks (or even 10, for that matter) on the last trade too, but I did not feel like waiting for it. Anyway, since KING is a discretionary methodology, in some situations you can go long or short, and it's up to the trader to decide which direction to choose. Often, both can be good, so that does not have to present a big challenge unless you are one of those people who are not able to make decisions on their own. But what this means is that you really cannot backtest a discretionary methodology, simply because it's not unique. I was once contacted by a blockhead who somehow could not grasp it. Even after I had explained it to him, he still kept pestering me about my backtesting results. But that's a totally different story ... I am now offering a KING holiday special, so you may want to take advantage of it while it lasts if you don't own KING yet.

It's a Friday (at last!) but not the 13th

It's November 16th and this Friday completes yet another full week of results started this past Monday. It's the 14th such a cycle this year, the previous one was completed last week. I wanted to stop at 12, if only because it's such a cool number (it's the first abundant number and the smallest multiple of the first perfect number, 6). But everything seems to indicate that I may even do 15 of these cycles this year. And we are less than 15 screenshots away from screenshot #400 in this ever growing gallery. I don't think #400 will arrive here this year, but rather next January. But there are well over 100 screenshots posted here this year already! So how hard was it today? Well, check out this screenshot of Sierra Chart charts that shows the time and position of my first and last trade (with lovely hands). There were 3 trades in-between and two of those did not take even a minute. As you can see, the price was dropping quite steeply and in a steady manner, so it was a child's play to take money from Mr. Market's hand. With KING's help, that is.

15th but still not a Friday

Just November 15th and a Thursday, so a very good day for those who like Thursdays. I am kinda indifferent towards Thursdays. I only have strong feelings towards Fridays and Mondays. The custom KING indicators for TradeStation have been released as you can see from this page. I woke up earlier today, so also traded earlier than usual. The market was a bit chaotic (no clear trend) compared to its action yesterday (see my blog for an update to yesterday's results) as you would expect it on a day following a wide range day, which may also explain why I scored no quickies today.

14th but still not a Friday

Just November 14th and a Wednesday. Also a day before the official release of custom KING indicators for TradeStation. Two new documents about these indicators and how to order them have been sent out last night. The indicators are only $60 till the end of this month. And did I mention those two sub-1-minute trades? I mean #2 and #3. Now, I did.

13th but not a Friday

Simply November 13th and a Tuesday. And one more quickie (the 4th trade). On November 15th, KING indicators for TradeStation will be officially released. KING owners will get more information about it by tomorrow. I like to keep my promises, but I do not plan to release KING indicators for any additional platforms. In the past 24 months or so I have released custom KING indicators for 4 different charting platforms and I plan to stop there. Plus, over 80% of copies of KING are gone now, anyway.

Testing a new monitor

I got myself a new monitor over this past weekend, so today I was pretty much testing it. I have a weird feeling that the ticks in the Bracket Trader ladder are now bigger which makes 5 ticks a "bigger" target than it was before, but I still managed 5-6 tick targets quite nicely, two in less than a minute each, so I don't think the new monitor is going to be a problem. In fact, it looks gorgeous, crispy clear and bright even at 40% of its maximum brightness. It's an Acer brand, pretty cheap but not bad at all. Incidentally, if this or other long pages do not load completely, you may be using Chrome. That's one of the "features" of this browser which overall is a neat looking piece of work, it's just sad it does not work too well. You may want to try Firefox or even IE instead. Two browsers I use most often are Chrome and Crazy Browser, the latter being a smarter version of IE. That's a memo from November 12th.

5 quickies to end the 13th full

week of trading

and less than 10 minutes of trading again, this time on November 8th. None of these 5 trades lasted a whole minute, which is nice, but the record in this department belongs to 10 sub-1-minute trades. This took place last year if I am not mistaken, or perhaps a year before. I mention it here. Incidentally, this is also the 13th full week of trades this year. I started this 5-day sequence last Friday. KING indicators for TradeStation will be coming some time next week, expect an update on it soon.

10 minutes of trading

Well, almost, but a bit less than that and $200 (a bit more, in fact) on a very volatile morning of November 7th, the day after the resounding Obama's victory. As I said yesterday, it does not matter who wins. Was I wrong? I don't think so. I did not stop trading after that, but I chose to update the results on my blog. It's easier to do so and it's one of the ways to promote my blog. Not to mention that over the years my site has become a bit crowded with all the information it contains, so I like to use my blog to highlight some of it.

No matter who wins today

you can still make money with KING. Given some practice and commitment, as those are absolutely necessary. I thought it was a good title for the election day report, on November 6th. 10 trades, 8 of them reached the full target, but all could have had I stayed with my positions a bit longer, and 3 did not take even a minute to get there. Not a bad day at all.

Against the trend

I was a bit against the trend today, November 5th, the day before the US presidential election. I tend to have a short bias, that is, I find it a bit easier to go short than long, as is amply reflected in the results posted here, but sometimes this leads to a sub-optimal performance. For instance, had I stayed with that reversed long position for 10 points as originally intended, I would have done better with four trades than I did with all eight that I took today. Well, still overall not a bad day but without any sub-1-minute trades.

A sandwich

A poor start and a poor finish, that's why I call it a sandwich. But overall, it was a good day, November 2nd, my first trading day in November. I could have reached the 5 tick target on my first position, but exited prematurely. Still, reversing it made a lot of sense (and I did so in a very aggressive manner with 6 contracts to offset my loss quickly) because the market kept on dropping till the very end of the session. The last trade could have been a 5-pointer too, but it was already pretty late, and so I decided to exit with whatever profit I might take. Not a bad day, and with a bit more of patience, I would have done better. Let me also note that 3 out of these 8 trades did not last even a minute. Do I sound like a broken record? Well, blame it on KING.

Lucky seven?

Well, if you really believe that luck has anything to do with it, then I wish you good luck because you definitely need it. The odds of getting 7 wins in a row by pure chance are less than 1% (1/128, to be precise). Notice that 3 out of these 7 trades did not last even a minute. Talk about good timing. Notice also that the last two trades, both long, pretty much marked the low of the daily session in a pretty strong trend. Pure luck? I don't think so. I have spent years practicing my craft using the same sound methods that you too can have for much less than others charge while having little to show for. You do the same, you may be that good too. Yet another October day, and the last one too. The KING's price went up as well. It's $1,300 now and that's hardly the highest KING price you will ever see. I am about to release KING indicators for TradeStation. Then I want to start a KING forum that I have promised too. In a way, while KING has been around for 4 years, with the forum it will be a totally new experience, certainly worth at least $1,500, which is the KING's next price level. Stay tuned for more.

20 minutes of trading

And the last trade did not last even a whole minute. When the market is moving well, you can take advantage of it with KING. Today is October 26th. I plan to release some new KING files soon and then the indicators for TradeStation. The price of KING is also going up.

Another "lucky" 5

And it took only 45 minutes or so for this $200 to accumulate with mostly 2 contracts per position at work. In fact, today, October 24th, I was trading in a tight range of 20 ticks only, so I did not have much of an opportunity to add to my positions even if I wanted. But despite a tight range like that I still squeezed 23 ticks out of it. Moreover, one of the trades did last even a whole minute (the second one). Not a bad day, again.

Easy day

Some days are like that. You can be totally hangover and still do well on days like that. No, I was not hangover, but I did not sleep well last night and was trading in a zombie mode. I am finishing my work on KING indicators for TradeStation and I plan to release them either in the last week of this month or in the first week of November. Stay tuned then. That's the memo from October 15th, yet another good trading day.

Late bird's special

There are early birds, there are also late birds (like yours truly) and then there is Big Bird. The last of the species listed is currently seriously endangered and may even become extinct if Mr. Romney wins the US presidential elections, which (as far as I am concerned) is about the only reason to vote for Mr. Obama. Yes, save the bird! It's a big one, too. Seriously, though, it was another good 30 minutes or so of trading with KING. This time on October 9th. And did I mention that the last trade did not last even a whole minute? Even Big Bird can't compete with this KING trader! He can still be more useful than most politicians, though, which probably explains why some of them are after his head.

Late start

I did not sleep well last night and was not sure if I should trade at all, but could not resist taking a shot at that reversal around 3:30 PM. I thought 20 ticks was possible, but I did not wait long enough for that to happen (I guess I need to work on my faith), but 10 ticks is still fine. Actually, even 40 ticks would have been possible, so twice as much as I anticipated. Not a bad 20 minutes on Friday, October 5th.

Very good start

Yes, very good indeed. The first two trades did not take even a whole minute to reach the standard target of 5 ticks. But then the market got stuck in a tight range, so I got two 3-tickers which could have been 5-tickers had I remained with my position longer, but I did not see it particularly attractive. Overall, I was trading in a range of merely 22 ticks, so those 27 ticks (per contract) that I managed to squeeze out of this range is not something to complain about. By the way, that's the 370th screenshot posted in the "I can do it too!" section of this site ever since I started posting them shortly before the last presidential election. Today is October 4th, the day after the first presidential debate.

Look, ma!

Another 10! That's right. And today is October 3rd. I was not too sure about the first trade direction, so I switched it to short when I realized that the chances for the price to go up were not improving. I could have squeezed at least 2 ticks out of this sucker, but was too sloppy. Those 3-pointers (per contract) too could have been 5-pointers had I stuck to them a bit longer. But all's well that ends well, and one of the trades was even a sub-1-minuter as I call them.

12th

All's well that ends well and today's trading had a nice ending indeed. At least one of those small losses could have been avoided, but I managed to recover from them easily. Anyway, that's the 12th cycle of full week results (meaning 5 days in a row). I was planning something like that this year, but did not expect to deliver it that soon. Last year I did only 10 of those, while planning 12 as well, that is one per month on average. Unfortunately, I ended up in hospital late last October, so I guess I am excused. I may not be posting here as much as I have been so far this year (have to finish some other KING projects), but I hope to do so at least a few times a month. Today is September 27th. And yes, one of the trades listed above is a sub-1-minuter (the third one). And did I mention that 10-pointer? An update has been posted on my blog. It's often much easier to post to a blog than to a static site like this one, but I am doing this also to promote my blog.

I so wanted to have a sub-1-minuter

Or whatever to call it. Yes, I mean a trade that does not take even a whole minute. And I got one. Yes, that's the last one. The next to last one was very close to deliver, but, alas, it took almost 80 seconds. Not good enough. However, the last one was just fine: 17 seconds is all it took for this trade to reach its standard target of 5 ticks. Now, that's the memo from September 26th. Actually, I got yet another one, shortly after I posted this screenshot. Well, here it is. I thought I was done for the day, but just could not resist what looked like yet another good opportunity.

How about that 10-pointer, eh?

I am talking about the first trade on September 25th, a good, volatile day. And the last trade was shorter than 1 minute, which I always like and which is not so unusual for KING. Yesterday, I also had one trade like that. I mean the 4th one. I don't count that 1 tick trade (the 3rd one) because it was rather accidental.

365!

And the day is Monday, September, 24th. I started posting screenshots like that on this site in late September or early October, 2008 (probably the latter), so it's been exactly 4 years since then. I wish I mentioned what date it was when I posted the first screenshot with my results in 2008, but alas, that was not the case, in part because I really did not know what to expect from the KING project. At that time, I still had to run my first KING mentoring session, and if it were not for the great results that that session produced thanks to PP and Dick, confirmed by others (John and Richard, in particular) in the session that followed in January 2009, I would have never continued this project that long. I mention this, so that you don't think that I have somehow planned all this out. No, not at all. I did not decide to start selling KING, it's just happened and I think that Katherine, my first KING student, is as much responsible for it as anyone else, including me. I think it's probably true that things that are not planned tend to last longer, because they have their own natural momentum, and that may even explain why temporary arrangements tend to be most lasting (just kidding a bit). Well, I don't expect screenshot number 500, the number of copies of KING is now limited to about 20% of what I ever intended to sell. There are about 252 trading days a year, so these 365 daily trading results in four years is more than one third of the total, but keep also in mind that I rarely trade more than 15 days a month (out of about 21 or so per month), I was posting less often during the first 6-12 months, and that not every result gets posted here. For instance, days when I have taken only one or two trades, almost never get mentioned here. Today could have been a day like that because the first trade netted me over $170 and it was only about half an hour till the end of the daily trading session, so I might have as well finished trading for the day once that traded was completed. Luckily, the market was showing good volatility at that moment and I was expecting it to decline even more, so I took a few more trades, doubling my net profit in the process as well. Anyway, it's still a very good time to get yourself KING. The last copies will cost $1500 or more.

One more to ...

well, to reach 365. Not a bad day for an anti-early bird such as yours truly. But I think I am going to take it easy, this Friday, September 21st, and stop here. The weather is nice too. Time to do some shopping. Need to get a new portable hard drive, and I need at least 1 tera.

Another day this week

Which would be Wednesday, September 19th. I usually do not post results like that as I aim at $200, at the very least, but they can happen from time to time, so I may post them for the sake of fuller disclosure, but more often to make some point. I could have done better, but I have been struggling with my gallbladder lately (probably for weeks, but only when it started kicking me in the ribs, I figured that was it), so my stamina is not what it should be and I see it in my trading. I was stuck in a range at first, and got a bit tired of that, but when the market started moving, I could not fully capitalize on it. You see, it's not enough to have a good grasp of the market, you also need to be in good shape mentally and physically. If you are not, this will impact your results. This reminds me of people who think that simulated results are always better than actual ones. Not really, because a good trader can produce better actual results than a poor trader can on a simulator, so the issue of simulated versus actual is not as black and white as most people think. In fact, it's usually poor traders who don't understand it. Same with the physical and mental stamina. If it is impaired, you may not be doing better than the average trader, even if you have a superior grasp of the market. Well, at least, the last trade did not take even a full minute to reach the regular target of 5 ticks, but just about 12 seconds!

Lots of 3-pointers

On this gorgeous Monday, September 17th. The market was very congested when I started trading, so I thought that targeting 3-pointers would be a good idea. Well, it was not a bad idea, but actually each of these 3-point trades (and one 4-pointer) would have reached the standard profit target of 5 ticks. However, that's hindsight and, alas, you don't have access to it in real time trading. Still not a bad day, overall. Notice that all these trades are short. I prefer the short side, but today the short bias was rather clear, so the fact that all of them are short is not particularly surprising.

11th

That's the end of the 11th 5-day sequence of consecutive trading results posted this year. Today, September 13th was a rollover day, and a pretty volatile day too. I started trading when the market was very extended after a solid run-up, so shorting it made quite a bit of sense. Anyway, I may be able to post another sequence like that this year, for the total of 12 (1 per month), but I am not planning more than that.

360!

And so the screenshot number 365 (also the number of days in a regular year) is coming pretty soon. This year, for sure. Lots of 3-pointers on this glorious day of September 12th, and all of them but one would have been 5-pointers as intended, but since the market seemed to be stuck in a range, I chose to be more cautious than it was probably warranted, at least in hindsight. The most annoying was the next to last position that kept bouncing off 13342 for 9 minutes or so, just one tick above my target and, sure enough, the target got hit within literally seconds after I had exited the trade. I knew this would happen, but just had enough of it.

Not feeling too well today

So only 4 trades on this sad day for America, 9/11. Two of these trades could have reached their intended target of 5 ticks and I was particularly irked by not holding long enough with the third one because the market dropped quite a bit and pretty fast too soon after I had exited this position, but I just got fatigued.

Effortless

Despite these two poor attempts that still ended up in the winning column (with 1 tick profits), it was pretty effortless trading. Today is September 10th. Uploading this to the Godaddy.com servers was anything but effortless, though.

Tight range again

As you would expect it after a wide range day yesterday. Sometimes it's easier to trade in a tighter range as the market is unlikely to move decisively against you. During my trading, the market was fluctuating in a range of only 20 ticks, so I think that squeezing out 22 ticks (per contract), which I did, is not so bad at all. And that's yet another memo from this week, today being Friday, September 7th.

7 seconds, 58 minutes, and 5 days

And all that took place on September 4th, the first full trading day of this month. One of the trades took only 7 seconds, the whole trading session of mine did not last even a whole hour (just about 58 minutes), and that's the fifth trading day in a row counting only the full trading days (yesterday was Labor Day, a federal holiday, and the trading session was shortened). That's the 10th continuous full week of trading this year posted here, so we matched last year, except that this year two of these full weeks were one after another, thus giving us two weeks in a row (in fact, it was 12 trading days in a row, so a tad longer than 2 weeks). You might have noticed that I usually do not trade before the noon EST, and today was no exception. There is a saying on Wall Street that "amateurs trade in the morning and professionals in the afternoon" and I agree that trading in the afternoon gives you some extra insight into the market possible action which can increase your odds of day trading success, but that's really not the main reason I trade in the afternoon. I am simply a night person, I rarely go to bed before the midnight the Pacific time, and so getting up around 6-7 AM my time does not sound like an awfully good idea to me. But you can use KING in the morning too, and you can find some examples of trading in the earlier hours here as well. Just not too many.

That's it in August

The last day in August was pretty much like all the other days. About the same number of trades, 5-6, sometimes more and sometimes less than that, and the results above $200, except for the very first day.

One more in August

Which means that it's the lucky 13th, the 13th screenshot this month, and the day is August 30th. I did not realize that August was that long. The market had a clear short bias, so you could trade relatively safely on the short side. It tried to rally, but it eventually dropped heavily into the daily session close.

Not bad, but ...

All of these trades should have been 5-pointers (per contract), and perhaps even 10-pointers (possible, but I did not plan it), it's just that I was not patient enough with the two of them. Overall, not a bad day, August 29th. But at least the last trade did not take even a whole minute. Such quick trades do happen time and again, two of them happened just yesterday.

Just another standard 5

Yet another week, yet another good trading day, this time August 28th. That's the 11th screenshot this month, could be the last one in August.

Completing yet another full week

Another good day, August 20th, trading in a relatively narrow range of only 30 points. That's also the fifth trading day in a row that completes yet another trading week, the 9th this year. Two of the past weeks like that were a part of a longer continuous trading period of 12 days, meaning longer than 2 weeks.

350!

That's the 350th screenshot and it comes from August 17th. After a wide daily range yesterday, the market was likely to remain stuck in a tight range, so I chose to take just a handful of trades. Considering that the market was stuck in a range of only 19 points during my trading hours, those 25 points that I squeezed out of it do not look that bad at all.

Pretty much mindless

The market was pretty extended, after a nearly 100 point run-up from the low of the daily session, at the time I started trading, which is rarely before the noon EST, and so I thought it was a no-brainer to go short. I was prepared to defend my position with some extra contracts, which I did at some point using 6 of them total, but overall that was the right idea even if someone else might have preferred the long side as safer because it was with the rather strong trend. That would have been good too, perhaps even more kosher, so as you see there is more than one way to skin a cat. That 6-contract position was good even for 10 points and so was the last trade, which I exited quite prematurely being a bit annoyed that it was not moving faster. That was one of those situations when being impatient, yet in a sound position, means that you should add to it rather than exit it. And that's the report from August 16th.

A bit of gambling

I could have reversed my position on the second trade, but considering how much resistance there was against the market moving up (see your 5-minute KING chart), I chose to stay put and keep pounding the sucker. I was prepared to risk 6 contracts and got very close to spending one more, but the market started reversing its run-up and eventually hit my 5 tick target. I could have scored 10 ticks too had I stayed put a bit longer, but it was already pretty late, so I chose to close the trade at 5 ticks. Well, anyway, a bit of gambling, provided you do have some good rationale for it, is not a totally crazy thing as some people may think. That's the message from August 15th.

Not a trading fluke

I could have avoided this loss, exiting with a 3 tick profit, but I got a bit greedy and careless and so I ended up the way I did. But I also realized that this was one of those situations mentioned by me in the past, last time even this month, where a relatively big loss indicates a potential for a good trade in the opposite direction. Indeed, that was one of those situations. Moreover, it was also one of those situations where you can literally bet your barn because the odds of success are so good. I talk about weighting the odds in a recent article in another section of this site, so I will not go into details here. Suffice it to say, when a situation like that presents itself, you want to increase your size if you can. And that's what I did, in part because I was pissed off. Being pissed off and acting on it is not always bad, but recognizing when it can work in your favor takes some experience. The market dropped over 30 points from my entry at 13137, so this good trade was no fluke at all, but had a great potential just as I had anticipated it. One of the obvious advantages of discretionary trading is that you can vary your position size. If you can, that is, because trading with 10 contracts is really not for those who start with $10,000 in their account. There are some other advantages to discretionary trading especially for a retail trader, so no wonder that KING can be a powerful tool that it is. This memo comes from August 14th.

Still too much Olympics

Which is not very conducive to good trading, so today, August 8th, was pretty much hacking.

Saving the day

This big loss could have been smaller. In fact, it could have been totally avoided, but I ignored my intuition and so it happened. Ignoring your intuition can be dangerous, especially if you also ignore what the market is doing. I did not do the latter, and reversed my long position when I realized that it was unlikely to recover. The rest is history. As you see, you can still recover from a relatively big loss, if you do the right thing, which may sometimes be a tough thing to do. As a matter of fact, and I said so before, probably on more than one occasion, a big loss is a very good indication of good volatility that you can take advantage of. Always try to see a positive in the negative. I saved the day, August 7th, and that's what matters.

Too much Olympics and other distractions

Well, it could have been a much better day, today, August 6th, but I was a bit too distracted and too impatient. These three sub-5 tick trades could have been 5 tick or better trades had I exercised a bit more patience and that's true especially about the second trade of the day. It was taking so long that I chose to abort it at 2 ticks only. Had I waited only a minute longer, I would have pocketed all 5 ticks that I meant to target originally. But overall, not a bad day. I was right about the market bias because the market dropped over 50 points since my first entry and I was on the short side all the time, but did not fully capitalize on my correct reading. With enough experience, you don't have to be perfect, though.

3 seconds and a full week

I don't often trade before the noon EST because I am a night person and need some 7-8 hours of sleep to be sharp enough to trade well, so today, August 2nd, was an exception and not a bad one. Notice that this last trade took only 3 seconds. While the market had a downside bias overall, I took a few long trades at a time I thought it was in a range. I was right about it, but eventually the range broke out and the market dropped even more. That's yet another full week of results, 5 days in a row, and the eight full week sequence just this year. I don't know about your place, but here in LA it feels like a weekend already ...

Another FOMC day

And a pretty scary one too. I stopped trading shortly before the announcement and that was a very wise decision as about 14:15 EST (that would be on August 1st) the market dropped sharply, about 50 points within a minute. It's not that I was on a wrong site of it as I had been short for several trades, but its volatility made me stop trading and then I decided to call it a day. That losing trade was a bit too experimentish for lack of better word. I keep reminding myself that I am a theoretical physicist by training, but this does not always help. Still, not a bad day, overall.

What a freaking round number

I did not plan it, but when I lowered my target from 5 to 4 ticks on the last trade, I knew I would get this number, that is, 200. I started late today, July 31st, and so I took only 4 trades. The 5-minute chart was telling me that the short bias was the right one, and so it was indeed. In fact, the market dropped quite a bit around 15:45 EST, as if to confirm that.

Still one more

Number 340 overall and it comes from July 30th. The market stayed pretty much in a range, so you could trade on both sides, long and short.

One more this month

And that would be on July 27th. The trend was very much up as you could have easily told from the KING 5-minute chart, so it made much more sense to attack the market on the long side. Trading can be very easy at times, and if you can identify those easy times, you will do well. I think using KING's 5-minute chart can help you with this task quite a bit. Incidentally, George IV has delivered 3 full wins (60 points each) in the past 30 days. I don't count losses and partial wins (less than 60 points), but I think that with a stop-loss of 45 pts (less than the standard stop-loss) and the standard target of 60 pts, this could be a pretty viable mechanical trading system. Just a thought, perhaps worth some further exploring ...

I am still alive ...

I have not updated this site for a few weeks. That's because I got some bad infection that I am still recovering from and not doing much business. If you have not heard from me lately, that explains it. This should change next month. A friend of mine is helping me with more urgent things, such as KING orders that keep flowing, and so you can go ahead and order KING if you so desire and he will help you with indicators, which is about the only thing most KING students need help with. Being a self-study course, KING is very extensive, and so virtually everything you might need is addressed in it and the rest you fine-tune by practice. You need to be able to practice because practice is really the key to becoming a good trader. I may offer a KING version for newbies, which would include individual mentoring, but, understandably, it would be more expensive. This screenshot comes from July 23rd. I may not post more this month, but I hope to resume more regular posting here in August along with the normal business activity.

One more ...

On June 18th, just to start a new week. I noticed that I posted in this section each week of this year, which means about 25 weeks or so already. I was stuck in the range, so I was varying my targets a bit, but because of the range I could also add a bit to one of my positions. That's about it for today. I raised the price of KING to $1100, and the next price level is $1500. No more than 10 copies will be sold at the current price level. Better?

Well ...

This is basically to let you know that all copies of KING at $1000 are gone now as of today, June 13th, so the price will be going up soon, and then some more. Another good day. That next to last trade could have been much better, but I was trying to play it safe. Eventually, the market did break down as I was anticipating, but I was done for the day. I need to take care of a few other things, the indicators for TradeStation being one of them. I have made some progress in this department, but still need to finish this thing.

I can do more ...

That's right. That's the eleventh day in a row, as of June 12th, meaning the first day of the third week in a row. I could do three weeks in a row. And I even may. But probably not this time around. Only when the price is right. Say, $1300, because $1200 is the current price of KING, except that temporarily depressed. When the indicators for TradeStation are finally released, the price will be $1200 again. Or even sooner. If you would like to see more recent KING testimonials, feel free to ask for them. I have not updated that page for a while, but that does not mean that people stopped saying good things about KING. I was a bit cautious with my targets today because I knew I was in a range, although not all this caution was warranted, but that's fine. Eventually the market broke out to the upside, but that was when I was already done and writing this.

Two full weeks

That's two weeks in a row, meaning 10 week days in a row. I did something like that 4 times in 2010. In 2011, I was more concerned with my health than trading and eventually had to have surgery, so I never even attempted to do that again. But I see that my stamina is back. Sort of. Probably, still not as good as in early 2009, for instance, but I am glad that it's better. I was stuck in a range, so I chose to lower my targets on 3 occasions, which proved to be rather unwarranted, but that's hindsight. Plus, Mondays are not my best days, so I tend to be cautious on Mondays. That's the memo from June 11th. Well, that's not the whole story. I traded a bit more later on, when I was more awake and it was obvious that the market would keep on dropping, and ended up with 10 trades. Unfortunately, the next to last one was a bit of a spoiler, being the result of an accidental exit that happened while I was adjusting my target.

Playing it safely

On June 8th, a Friday, so I have the right to be lazy. I got up quite early today. I am not sure what's the occasion. The number of this screenshot is 333, a half of the Devil Number. I am not sure I will ever reach the Devil Number. I doubt it. The number of KING copies is limited. The timestamps are in EST again. Well, that's it for this week. Almost, because I did some more trading finishing the day with the perfect 10.

Rollover day

On June 7th, another Thursday, the first this month. A rollover day is on the first Thursday following the first Friday of March, June, September and December. It was a slow moving market, so slow that I was getting bored. I started watching the old contract and noticed that it was moving swifter. That's the reason why I sometimes trade the old contract on the rollover day. And sometimes I might have forgotten to switch and did not see any major impact from the transition day. Anyway, the clock did its thing again. The time is really UTC-4 and not UTC-5 (EST), and I really did not trade at 16:18 EST because the market is closed then, but that trade took place at 3:18 PM EST. It's the second time this week that my computer switched to UTC-4. It used to do it once or twice a quarter, which was tolerable, but it' not anymore. I need to do something about it.

ES again

On June 6th. Just a few trades. Feeling sleepy, but I slept till 10 AM, about 8 hours. Oh well. That's the 7th day in a row with KING emini trading results. I thought I was done for the day, but I actually added 4 more trades as you can see here. Each of these 4 trades could have been at least a 1 pointer, and the last two even 2 pointers, but I was not aggressive enough for that. Well, not a big deal. On some days I am just slower. Also, George IV has delivered another 60 points again today, exceeding its target by dozens of points. That's a third such a success since I released it again just a few weeks ago.

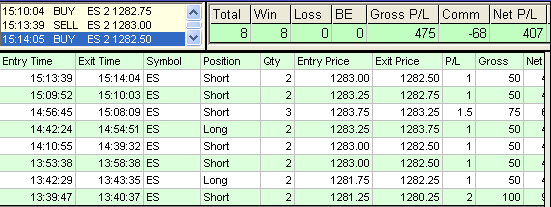

ES for a change

I am sometimes asked if you can use KING for trading ES, and the answer is yes. Of course, you can. I used to do it in the past, and thought I would return to it, just to see if things have changed. No, not at all. Only the commissions are lower now. At least with IB. Incidentally, those shown by screenshots may not always reflect the actual ones. I don't think BT allows you to adjust your commissions when they change. Notice that 3 out of these 8 trades did not take even a full minute, so things can be as snappy with ES as they are with YM. Well, anyway, that's the memo from June 5th. Remember, today is the Venus transit day. The second and the last Venus transit in this century. The next one in 105 years. I somewhat doubt you will be alive then, but by all means keep trying. You can watch the transit online. That's what I am going to do. Here is more about the transit and where to watch it online.

Another full week

This screenshot comes from June 4th. The times stamps are not as usual, that is not in EST, but one hour earlier, UTC-4, not UTC-5. It's the time of some places in Canada, but not in the continental US. Unfortunately, my computer failed to keep the right time again. I mentioned this problem in the past on a few occasions. It likes to switch to UTC-4 from time to time. It's just some odd glitch. I usually notice it the very same day or the day after. Well, yet another full week that started after the Memorial Day.

Not a bad start in June

And that means on June 1st. But it could have been better. Unfortunately, the market did a bit too much (for my Friday's taste or patience) zigzagging and that caused me to lower my targets quite a bit on most of the last five trades. Eventually, the market broke down and reached new lows as I was anticipating, but that took a tad longer than my Friday patience would allow. Not a bad day, overall, but could have been better.

A quickie

On the last day of May. Only 15 minutes. Did not get much sleep last night, time for a nap. So I took a nap and then some more trades. Actually I took one more before the nap, but that was nothing to write home about, but the remaining 4 were quite good.

More wine money

What the heck. Now I don't have to worry about my wine supplies for the next 5 years unless my place is raided by a bunch of Frenchmen. Today is May 30th, and it was yet another good day. That 6 contract position took a while to reach the target, but I was betting that the price would bounce off of some "magic" line in the 5 minute chart and that's what indeed took place. Yep, I do have a crystal ball. It's called KING plus experience. But 3 out of these 7 trades did not take even a whole minute, so my timing today was pretty decent overall. That's the 14th post this month, if I am not mistaken. I did not cheat one bit by hiding trades, so paranoids out there could sleep well all May. Incidentally, I could give you more reasons for showing smaller pictures (with fewer trades displayed) than I did in the not so distant past, but they are somewhat technical and have to do with the SEO.

Beer money

Actually, it's more like wine money. I don't drink beer that often, but I do drink wine. Doctor prescribed, so I have a totally legitimate excuse, no kidding. Too bad that it's not covered by my health insurance. I drink red wine, of course, and only about 100 ml a day, which is hardly an overkill and it's probably much less than what the average Frenchman drinks every day without asking his doctor for advice. Well, it's Tuesday, May 29th, and that's just a brief memo to let you know that I have survived the Memorial Day weekend and keep working on KING indicators for TradeStation. Unfortunately, time and again, I get interrupted by people I would rather not deal with, and that slows me a bit every time I deal with someone like that. Good day, overall, and about 100 bottles of that el cheapo California wine that I drink.

Addicted to 13

Or something. This is a screenshot showing my emini trading results from May 25th, another dreaded Friday. But it was a good Friday, so the dread was unwarranted. And I even managed without a loss. Well, not that this is really a big news. What's nice about today's results is that out of these 13 trades, 4 did not take even a full minute, and one was a 10-pointer. That's certainly nice. You may also notice that the first 5 trades, to the tune of 25 ticks per contract, were carved out of the range of only 18 ticks. Not bad, but don't try it without KING. Well, I thought today's results were good enough to brag about, but that's the 12th screenshot this month, and you will probably not see more until next month.

Another lucky 13

It comes from May 24th. I could have avoided that bad loss. I really wanted the price to hit my 5 tick target, but to no avail. Since I was up over $600 at that time, I could afford to be more aggressive. It came close, just 1 tick off of my target. I then reversed my position expecting the market to go up. I was right. The market surged over 90 points since my first long entry. Notice that one of the trades is a 20-pointer (the reversal trade) and another one is a 10-pointer. Yet another trade stands out in that it only lasted 3 seconds! And it was the third one today ... I traded some more this week, but with over 10 screenshots this month, I think I have posted enough already and this could be the last post for the month unless I have something spectacularly good to brag about. Like, say, another $1000+ day. Incidentally, there are only 3 copies of KING left at $1000. Once the KING indicators for TradeStation are released, the price is going up to $1200 again. Yes, I am determined to release these indicators, there is actually a much bigger interest in them than it was in the indicators for MultiCharts.

The fifth full week this year

I hated my trading today, Friday, May 18th. I was a bit drowsy, did not get much sleep last night and my poor timing was making me angry. Out of these 7 trades, only 2 were well executed, others were poorly timed, although, fortunately, I did pick the right market bias, which was downside, despite the market's attempt to stage a brief rally. Well, I stopped at this point. Being angry is not very conducive to your trading. That's probably the worst mood you can trade in. That's yet another full week of results. Too bad it does not end on a better note, but some days are like that and you just need to accept it.

Those lucky sevens ...

Now, this loss was accidental. Ordinarily, you don't want to trade about 10:00 AM EST unless the market has a strong bias, which it had today, May 17th. And it pretty much retained this bias during the first hour of the daily session and so I was on the short side too. I took a nap and traded a bit more in the afternoon as I usually do. The result was a "lucky 13" which you can check out here. That's the first $1000+ result this year if I am not mistaken. There was room for more as the market would drop about 60 points since my last exit, and I was on the short side, but I had to take care of a few other things. Still, you do want to take advantage of a clear market bias as much as you can.

Still easy ...

That bad trade did not have to happen. The 5 minute chart was indicating that a reversal was quite likely in this area, but the price had such a strong momentum in the 1-minute chart that it was very tempting to take this trade. Well, too tempting. But one bad trade does not have to ruin your day. Just the opposite. It can be a good learning experience in more than one way. It can tell you the right market bias and how you handle its aftermath can tell you a lot about yourself. And you might still end your day in the positive territory. It's easy to handle winning trades, it's harder to handle those that are not, but that's the situations that you need to master really well if you want to become successful in this field. These are the situations that can make or break you as a trader. What you really need to master is to trust your method and to trust yourself. Most wannabe traders never succeed in part because they fail to develop this aspect of their trading game. They may even not know that this is important. The trust is not the same as the belief. It's easy to believe, it's quite natural for most people, it costs nothing and it often comes with the generous reward of hope. To trust is not so easy, developing it requires effort and the rewards are not obvious. No wonder then that many wannabe traders would rather believe that someone out there has a magic method that will solve all their trading problems than to develop trust in themselves and their methods. I think it's easier to develop trust in KING compared to many competing products because of so much evidence of how sound it is, but that may not be enough for "the believers" who prefer hope to truth. Overall, it was a good day, May 16th, and that P/L dip was fixed in no time.

Easy half an hour

Actually, less than that, only about 26 minutes, if I am to be precise, and the result is very similar to the yesterday's. Notice also that the first and last of these trades did not take even a whole minute. Yes, there was room for more, but I am pretty busy these days, so I decided to stop at this point. The market dropped quite a bit from there, though. That's the memo from May 15th, yet another good trading day for KING.

Easy money

Yes, sometimes, it's a child's play to make $200-300 within an hour or so with no sweat as was the case today, May 14th. If you use KING, that is. Those who don't are kindly advised not to try it at home, so to speak ... There was room for more, but I stopped there.

One more full week

And it ends this Thursday, May 10th, a day after a big parade in Moscow (kidding a bit, but these guys are into parades quite a bit), so I am also in a somewhat festive mood. Not to mention that I am drinking red wine (doctor ordered, seriously, and the doctor, what a coincidence, is from Russia) when I am writing this, so I am in good spirits. That 6 contract position was a bit of a gamble, but my reading of the 5 minute chart was telling me that we were in a range with the downside more likely than the upside and indeed the market blew through the daily session low eventually. That was a gamble, but a smart one, and trading, let me remind you, is gambling. If you are a smart gambler you can win. If you are not, you end up blowing an account. If you are a really stupid one, you blow two accounts and start a trading forum (not making this up, real life case) to guide other really stupid gamblers towards blowing their accounts. Overall, my timing could have been a tad better today, especially with the exits. Three of them could have been better. Well, that's the memo.

Hmm ...

It's the second day in a row that I am getting up that early. It's either the weather (getting warmer) or the old age. Well, I think that might also have to do with my diet. I am switching to a vegan diet. That is, if sour cream (non-fat) is part of it, then I am all in. I am assuming it is, or else I will simply die of starvation or lack of protein. Anyway, the market had a strong bias to the downside at the open, which I exploited, even with 5 contracts at some point and was willing to pile on some more being pretty much sure that the market was bound to reverse at some critical line in the 5 minute chart, which it did. It could have reversed at 10:30, though, which it did, so I was cautious here and simply stopped trading about this time. I was getting a bit sleepy after only 5 hours of sleep last night and some sour cream that is meant to prevent me from starvation. So, that's the story of May 9th, which in Russia and parts of Europe is celebrated as the World War II Victory Day.

A stranger ...

to this hour. Yes, to this early hour, that is. I have not seen the market that early during the daily session (the first half an hour) for years being not much of an early riser. I was quite surprised how volatile it was. But both 1 minute and 5 minute charts indicated the short bias and so short I went. I even caught a bit of a reversal (the last trade), not much, though, as the market went down again, but you can't argue with my flawless timing of this short upside move. I am talking about May 8th, or yet another good Tuesday. Back to bed, I guess.

Stressful day

It's been a stressful Monday for me. May, 7th, that is. I started trading very late because of that, had to cool down a bit, but I usually don't start trading until after 12 EST, anyway. The first trade was a loser, in part because of my greed (5 points might have been possible), but that loss told me that the short side was where the money was. It's yet another example of a situation mentioned by me in the recent past on more than one occasion when the first losing trade sets the stage for good trades in the opposite direction. The market eventually dropped about 40 points from where I reversed my position, so I was right on the money.

Hunting for 10-pointers

5 out of these 6 trades are 10-pointers (per contract) and the last one could have been had I stayed with my position till the daily session close of this Friday, May 4th. Yes, that's yet another of those "too good to be true" results, to use the parlance of mediocrities, or "miraculous" if you are inclined to be a religious person. In reality, that's neither. Today was simply a very good day, so good that even George IV, that I offered for sale again recently, gave a very good signal and even delivered 60 points by the session close. It's a good system that can help you with your trading even if you never buy KING, but of those who bought George IV recently, some bought KING next, which means that George IV is good enough to inspire faith in KING. I intend to modify this system to make it more suitable for lower volatility conditions, which will lead to fewer but more reliable trades. Still, in good volatility conditions that this system was designed for, it can perform as well as ever.

Another loser ...

that was followed by a big winner. The thing about KING is that if your trade goes strongly against you, it's a good indication a trade in the opposite direction holds a greater promise. I have showed two more examples of this in the screenshots posted here over the last few weeks. This screenshot comes from May 3rd. I am afraid this will be a slow month, for more than one reason, but last month I posted 11 times here, so I hope you will excuse me if I don't post in May as often as I did in April.

Better late than never ...

Started pretty late, today, April 27th, and was extra cautious because of that and because the market was pretty much likely to stay in the range at the time I started trading. That explains those smaller targets. The range expanded though, and I was on the right side of this expansion, but did not take full advantage of it. For instance, the last trade could have been a 10 pointer, although I wanted to get only 5 ticks out of it. Still, I reached my daily goal, so it's not like I have a particular reason to complain. It's always good to see the bright side of things ...

Nice brackets ...

And by nice brackets I mean the first and the last trade, which have a neat thing in common: they took less than a minute each. Overall, none of these 5 trades of April 26th lasted more than 2 minutes, which is another nice thing, for sure. And $200 in less than 20 minutes is, like, more than 10 bucks a minute, not a bad rate, at all. Well, I woke up early today, did not get that much sleep last night, but it was better than a night before. Still, I guess, I am going back to bed. That's the 10th screenshot this month.

Waiting for a 20-pointer

It did not arrive, but it could have, had I waited till the last minutes of the daily session of April 24th. The second trade was aimed at 20 ticks, based on some setup that I elaborate on in a new video and Word file to be released to KING owners some time this week. It was possible to score 12 ticks over an agonizingly long period of about 90 minutes playing it by the book, or even 20 ticks if you were lucky (or skillful) to get the average entry at 12942 or lower, which was certainly possible, but the market was meandering so badly during these 90 minutes that I lost my patience after 45 minutes or so and chose to play the range instead. Still, had I stayed put with that second trade, its outcome would have been $300 before commissions. Oh well, taking profits sooner rather than later is also not a bad idea.

A full week, (less than) 30 minutes, and 3 seconds

It's yet another full week of results that started last Friday, the 13th, and ends right today Thursday, the 19th. April, that is. Today's results span a period of less than 30 minutes and the fastest of these 6 trades took only 3 seconds! Moreover, 4 out of these 6 trades did not last even a whole minute. Not bad, not bad at all. Now, is your trading teach that good too? Well, I actually know the answer, so I wish you good luck.

Much better ...

The day, April 18th, started with a small loss that I took when the market failed to overcome resistance at some critical point, in the very much the same circumstances as on April 13th, where I also incurred a small loss. However, today the market had a greater momentum than the other day, so I was hoping that the outcome would be different. Alas, that's not what happened, but I was able to recover quickly with a 10-pointer which was followed by 9 more winners. Just as on April 13th, the price corrected quite a bit after failing to overcome the said resistance, about 50 points. And when the market returned to the resistance area, I was ready for it with 6 contracts and took a mighty revenge on the sucker.

Tax Day

On a painful day like today, April 17th, I was struggling a bit climbing out of a hole that I got myself into on my first trade, but as you can see, I emerged victorious by the end of the daily session. It's not that I was particularly wrong about my short bias on the first trade, but my timing was not good, for sure, so my stop-loss got hit. I quickly re-entered, though, and stayed on the short side for the rest of the session. Had I stayed with my 6 contract position for 10 ticks, as I originally intended, I would have improved my balance even more. Same with my last trade in which I wanted to aim for 5-6 ticks, and that too would have been reachable, but I was literally running out of time, so decided to take a smaller profit. Still, as you can see, the drawdowns with KING can be quite manageable, and they are unlikely to be big, although you may get yourself into a hole from time to time. Yes, stuff happens, and you need to accept it if you want to be a trader. Two out of these 7 trades did not last even 30 seconds, so my timing was not entirely bad today.

20 minutes of work

On this Monday, April 16th. This may not look like hard work, but try to do this with anything else than KING and you will see that it might be. Incidentally, one of those beauties was sub-1 minute, actually even sub-30 seconds.

The beauty and the beast

I am the beast and the beauty is what I do for a living. This screenshot, that comes from Friday, April 13th, features two 10 pointers and one of those sub-1 minute trades, but it also contains one loss, and that was a smart loss to take. I knew the market was very likely to reverse here, and I based it on the 5 minute chart, but I was hoping that I still might squeeze 5 ticks out of this position. Alas, Mr. Market refused to cooperate (I swear to sue the bastard if he does it one more time) and I got turned away 1 tick shy from the target. The price then dropped and I knew that the market was now poised for a drop, probably a big one, and again I based this on some configuration in the 5 minute chart. Indeed that's what happened (the market dropped about 80 points from there), so I could quite easily compensate for my 4 tick loss with a 10 tick gain and then a 5 tick gain. I could have traded a bit more, but after $500 in profits and being hungry I chose to raid my fridge instead. I intend to explain my rationale behind all those trades in yet another educational KING document and those who own KING will see that what I was doing was very much based on what I preach in the KING course. Now here is my question to those who don't own KING: are you still using that system that every moron is supposed to make money with? Well, don't worry if you are not making money with this thing. That might as well be because you are not a moron, in which case you are a very good candidate for KING.

I so wanted ...

One of those sub-1 minute trades, that is, and I sooo did not get it. After the 5th trade, I realized that volatility was good enough for one of those sub-60 second trades, so I decided to go for it. The result was pretty ironic, yet quite representative of Mr. Market's twisted, if not sick, sense of humor. The very next trade (the 6th in a row) turned out the longest one, but I was sure I was on the right side of the market and chose to improve my position by adding to it and ended up with a very nice overall profit on this trade, and my last trade lasted just 61 seconds! I gave up after that. Well, you can't always get what you want. I was really kidding about being back to shorter screenshots forever, but I sure am back to posting the full picture, literally and figuratively, only when there is some story to tell, which is not always the case. That's what I was doing before too. It's rather pointless, from my perspective, at least, to show all the trades if there is nothing interesting to say about them. And it's wasting the bandwidth too. This screenshot comes from April 11th.

302 or back to normal

I am back to showing the shorter form of results, having pacified conspiracy theorists with quite a few long screenshots of my results over the last few weeks, probably 10 or so. If they are still not happy, I can live with that. Today is April 9th, yet another dreaded Monday.

301 or yet another lucky seven

I woke up unusually early today, April 5th. Unfortunately, since my heart surgery last year I get fits of insomnia and that was the reason I was up so early. I did okay, but I am going to bed again. Feeling sleepy. I briefly traded yesterday too, but did not post it here mostly because I was busy helping some of my KING clients. Here is the result of yesterday's trading (the time in the timestamps is advanced by one hour because my computer did not keep the time again). I will probably be posting sporadically this quarter, as I need to focus on other things more, and frankly, I am finding it more and more boring. I guess that also explains why the overwhelming majority of vendors out there never show even the slightest evidence that their trading ideas can make money. They simply figured out that doing so would be unbearably boring and hence never bothered. I get it now.

300!

Today is March 28th, Wednesday, and it's the day screenshot number 300 arrived here. Its longer version is here. Less than an hour of trading, over $300 with 2-3 contracts per position, or, in other words, classical KING trading. It was a good day with a strong downtrend, so staying on the short side made a lot of sense.

299

That's one screenshot away from number 300. I took it on March 23rd. Its longer version is here.

Mr. Round

Today, March 22nd, I am Mr. Round. Look at this perfectly round $200. Heck even the gross P/L is pretty round. But that's not all. I have hidden one more thing in the long form of the results, just a special treat. It's a 10-pointer. In this rather congested market, these are not so easy to get. But there is still more: we are now only 2 screenshots away from Screenshot #300 and when this guy arrives here, probably even this month, I will declare myself Mr. Super-Round.

Another full week

Today is Monday, March 19th, and that's the fifth trading day in a row. I started trading when the market went up strongly, but after a strong move like that it often settles into a small range, and that's what my results reflect: only one 5 tick trade, the other are 3-4 tick trades as you can see from this longer version of my results. I was too busy with other things today, so finished trading earlier than I might have otherwise. Just a reminder, the indicators for MultiCharts are ready and I will be releasing them starting tomorrow.

Overconstipated

Just like yesterday, I found myself trading in a very narrow range of 15 ticks, but unlike yesterday, there was no clear trend in the 5 minute chart that I could use to my advantage. Yesterday, such a trend was up, and as you can see from the longer screenshot of yesterday's trades, the long trades were much more successful. But today, without this extra bias, it was a struggle that I decided to end after 10 trades, none of which resulted in at least 5 ticks of profit. The market was not just constipated, it was overconstipated. I usually don't show here results below $200, but when I do, it's to make some point. In this case, to show how a narrow range in a market with no clear direction in a higher timeframe can result in a struggle like that. See the longer form of the recorded trades to see how little I could squeeze out today, March 16th. The biggest profit per trade per contract was only 3 ticks.

Nibbling

With the math holiday over, on March 15th, I was somewhat less inspired in my trading. Also, the range was so small (15 ticks only during my trading) that all this nibbling (see the longer form of the recorded trades) I did today was pretty justified. This small range also explains those two losses, albeit small, as you would expect in a small range.

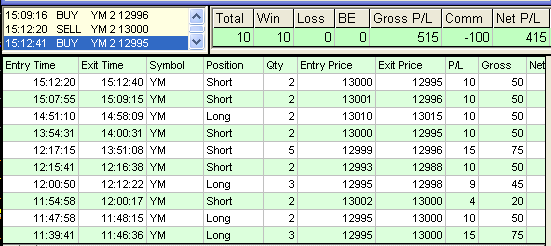

Pi Day

Today, Wednesday, March 14th, is a Pi Day, so for someone very mathematically minded, as yours truly, it's basically a holiday. But I traded today, and it was a good day with all (10) winners, some of which were aimed at smaller targets than the standard 5 ticks as you can see from the long screenshot. The market was rather shy when I was starting trading and since yesterday was a wide range day, I was expecting a narrow range day today, and hence I thought that it would be hard to score 5 ticks regularly. I was not entirely right, and quickly switched to regular targets once the market started showing some life.

FOMC Day

Today, Tuesday, March 13th, was one of those FOMC days (a glorified name for a napping session of a bunch of old farts that may or may not know something about the US economy), but I traded through the announcement because of an excellent trend in the 5 minute chart. Had the trend been weaker, I would not have done so. As a rule, since volatility spikes quite a bit on a day like that around 14:15 EST, it's a good idea to take a break for at least 15 minutes starting around 14:10. I knew the trend was strong based on George IV ideas and I mention this in part because I made this system available again, probably for a while only, but as a strategy. Today this system came very close to flashing the long signal, yet one condition, albeit not very critical, was not met. Still, using it as a strategy you might have entered per its suggestion and had you done so you would have made money on the long side. The main advantage of this system even when used as a strategy is to alert you to a strong market direction. It's always easier to trade in the direction of the strong trend. Here is the longer version of today's screenshot (for "the birthers"), and, as you can see from it, all my trades today were on the long side, which is somewhat unusual as I prefer the short side, but made total sense due to the strong uptrend.

I can't believe it's only 6

Trades, that is, because it felt like 12. Well, it must be another Friday fatigue or something. Anyway, I was stuck in a range for an hour or so, yet managed to take 3 trades in it, and then the market broke out, so I took 3 more. I must say that after the first 3 trades, it did look like another sub-$200 day, which I may not even report here, but fortunately that was not the case, in part due to the increased size that I could use to take advantage of this volatility surge. This memo comes from March 9th.

8 on March 8th

And that explains everything. We are now less than 10 screenshots away from 300. I plan a trading room and may start posting here when the room is up and running. I have been working on some strategies for it lately in addition to working on KING indicators for MultiCharts. Obviously, the room is meant only be for KING owners.

Sometimes 10 is enough

To reach $500, that is. I did not use more than 3 contracts per position, mostly 2, though, and my targets were between 5 and 10 ticks owing to increased volatility. Thank you, Greece! Or whoever/whatever might have been responsible for that. I am very close to releasing KING indicators for MultiCharts. I think I will start doing so by March 15th. The indicators for Tradestation will follow shortly afterwards. Today is March 6th.

Who is afraid of 14?